Bank Reconciliation

Why Reconcile?

You’ll often enter expenses in your journal as you write a check or enter revenue when filling out a deposit slip. This means that your journal balance and your bank balance will often differ.

Reconciling doesn’t fix this discrepancy, but it can help you verify that the posted amounts in your journal match the amounts posted to you bank. This helps to identify errors or omissions in your journal.

When to Reconcile?

You can reconcile whenever you want, and as often as you want if you have online access to your bank accounts. You should try to reconcile at least once per month. Any longer than a month and you’re making it harder to find errors and omissions, and probably not saving yourself much time in the long run.

Steps to Reconcile

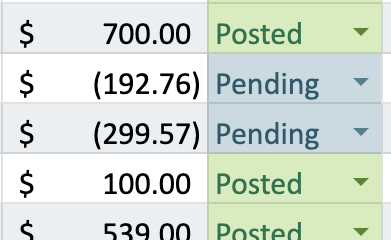

Open your bank statement or online account. Check to see if any transactions with a “Pending” status in your journal have now posted to your bank. If they have, update their statuses to "Posted" in your journal.

Check to see if any transactions have posted to your bank that aren’t in your journal, such as a utility bill on auto-pay. Add any to your journal with a status of “Posted”:

At this point, all transactions in your bank statement should be in your journal with a "Posted" status. All other transactions in your journal should have a "Pending"status.

Go to the Reconciliation sheet.

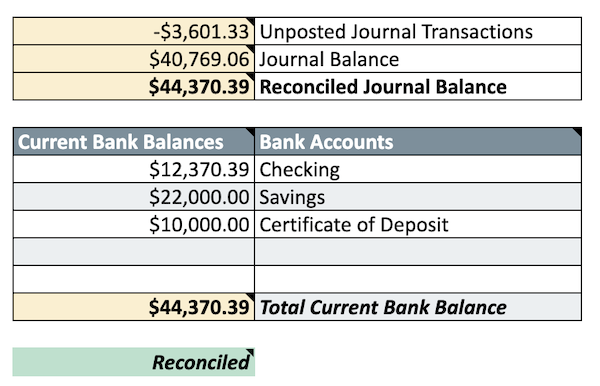

The light yellow cells are automatically calculated and should not be altered directly.

All bank accounts, such as checking, savings, certificate of deposit, etc. will be entered below along with their current bank balances. This will add all account balances to the Total Current Bank Balance.

If you are reconciled (bold values match), you’ll see the reconciled status at the bottom:

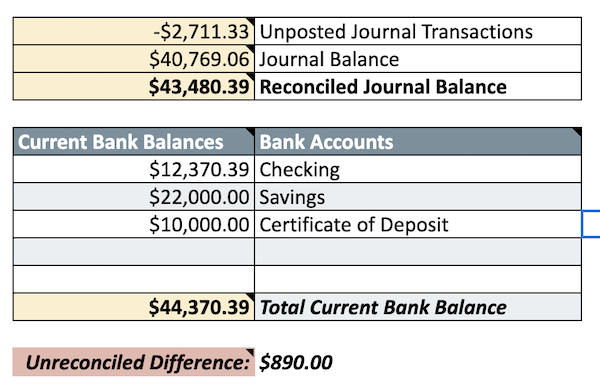

If you are unreconciled, you’ll see the unreconciled status and the difference at the bottom:

If not reconciled, go through all the steps above again to double check that the values and statuses of each transaction in your journal are accurate.